C4-world is building an online platform; MyC4, which will allow companies across Africa to source loans and equity investments from the global community.

To source investment opportunities, we will work through a combination of partner organizations, including Funds and NGOs that work with African entrepreneurs and SMEs, established companies who will give us access to African SMEs in their supply chain, and local banks and microfinance institutions who have an interest in sharing risks or expanding the reach of their operations, as well as recruit some of our own local credit officers.

The platform will allow people from around the world who create online funded investment accounts to participate in auctions (they will bid an amount and the interest rate they wish to earn) to fund the loan requests posted by the entrepreneurs and SMEs.

In addition, we have started work to raise two funds (target $50m each). The first fund will be a microfinance fund, investing both in microfinance institutions themselves, and also at the actual microfinance loan level, using knowledge and analytics captured from the flow on our platform.

The second fund will be a private equity fund, investing in a combination of other funds, and directly in companies (with a focus on earlier stage investing than most current African PE funds), using the analytics, networks and knowledge from the flow on the platform and the microfinance fund.

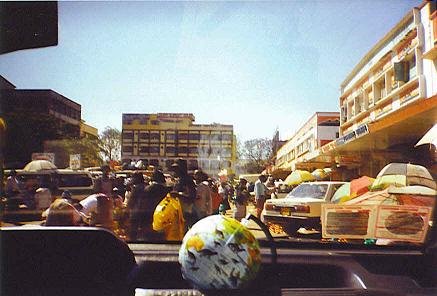

We will launch in Uganda first, where we have the strongest network of contacts, then plan to expand to the rest of the continent soon thereafter (neighbouring East Africa, South Africa and Ghana are high on our list of countries to expand to).

When making loans or investments in the companies, whether directly through our funds, or on behalf of the investors on our platform, we will typically need to work with local banking partners to issue, administer and document the loans.

The plan is to provide these partner banks 100% of the underlying capital to fund the investments/loans, and to rely on the banks' infrastructure to actually issue the loan on our behalf, and administer it.

We are targeting a launch date of May 1 for the "Beta site" of MyC4 which will operate in a controlled environment and expect to "go live" to the general public end this year - we are in close contact with major Danish pension funds and expect to launch the first two funds in 3rd quarter of 2007.

Special Thanks to Annelise and Tim of C4-World for providing me with this breaking news from Uganda, by way of Denmark.

Of course, I love your comments. But, if you can't comment at this particular time- but would like to let us know that you were here; please sign and View my guestbook

Tags: C4-world, Uganda, Microfinance, Microfinance in Africa, Microlending Africa, SME's in Africa, Africa investment fund

Tuesday, March 13, 2007

Speaking of Finance for African Enterprises...

Subscribe to:

Post Comments (Atom)

5 comments:

super, super, super! much success on this initiative!

Bravo!

A wise man once said"the world is yours" yet still, it seems the smartest of professionals of today have not quite grasped its meaning when it comes to private enterprise in Africa.

My only concern with the C4 venture is that it will endelibly handicap companies in Africa who even thought meet goals of capital(may have to give back interests double the loans taken out in the first place).

But when you mentioned "microfinance" fund my ears were tickled in connection to a grassroots "micro"banking sytem going on in India (that specifically caters to the poor who happen to have business but owe unsurmountable loans).....I'm not saying this applies to your potential clients but, what I like about your "microfinance" approach is that the integrity of the company will remain and be free of the "too many Kings"-syndrom.

Looking forward to the May 1st launch...Blessings Benin

-Kesiwaa

Kesiwaa:

Happy to see you stopped by, I hear they are taking this concept to your favorite place in the world [thats Ghana right? :) ] too...

Thats an interesting point on the interest rates...my thoughts on business microfinance is that as long as the venture or project that its funding really has the demand to justify or necessitate loans, then it makes sense. If for instance the rates end up outweighing the probable returns, then me like you...I'd say its a no no. From what I have read about C4, they seem to be modeled after a "fair enterprise" sort of approach.

Sijui:

Thank you my friend! Sorry its taken me long to repsond. But I am happy to be noticing your comments apperaing on TBE again!

Benin, thank you for posting about us...

Kesiwaa, it is an interesting point about the interest rate that you raise here!

One of the overall purposes of building MyC4 (online investment platform) is to get a self-sustaining community where elements like the interest rate will be decided by market forces >> theoretically, the interest rate can end up being close to nothing if the investors REALLY want to be part of realizing a specific African business!

And as Benin writes, if the interest rate is too high for the borrower, he/she simply turns down the offer of the loan.

I encourage you to become MyC4-builder if you feel like you have something to offer when we test the platform in a closed environment from May to end 2007. You can read more on our blog; www.c4-world.com

Dear Friend,

I have seen a very good website www.onlimoney.com and found the recomendation is very fruitful its a fourm on which i can discuss stock and commodities sector.

Sign Up today at www.onlimoney.com

Post a Comment